Python and Statistics for Financial Analysis

Python and Statistics for Financial Analysis Training

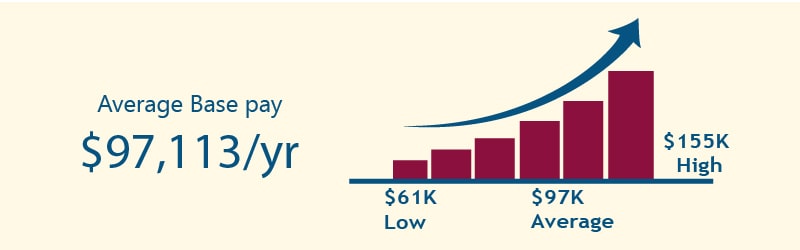

Python has become a very popular language as it is simple to code and it is easily readable. Many people are opting for Python and Statistics for Financial Analysis Training as they can get jobs in many industries with a high salary. Python and statistics for financial analysis is a course in which a candidate will learn coding with python along with the concepts of statistics. This knowledge will help them to analyze financial data and help the organization to improve financially.

Course Overview

Python for financial analysis course is a course that will let the students know about Python language and its usage in statistics for finance. Students can do various types of things after completing Python for finance course. They can analyze stock data, save the data in the Panda Dataframe, generate new variables and make changes in the financial data if required, and many more things.

Key features: standard set of course features

- The Python finance course will be led by an expert instructor.

- Both theoretical and practical aspects are included in the Python finance training.

- Know about the role of statistics in finance

- Get knowledge about the relevance of statistics in finance

- Know-how is Python used in the finance

- Availability of training material pdf

- Tutorial for financial statistics with Python will also be provided

Who Should Learn Python and Statistics for Financial Analysis?

The course can be done by anyone to get the knowledge of finance, statistics and their usage in Python. Data scientists, beginners of programming, people having background of investment and finance, and people who have done graduation in finance can pursue the course.

Top Hiring Company

Industry Trends

Course curriculum / Syllabus

- Why do investment banks and consumer banks use Python to build quantitative models to predict returns and evaluate risks? What makes Python one of the most popular tools for financial analysis? You are going to learn basic python to import, manipulate and visualize stock data in this module. As Python is highly readable and simple enough, you can build one of the most popular trading models - Trend following strategy by the end of this module!

- In the previous module, we built a simple trading strategy base on Moving Average 10 and 50, which are "random variables" in statistics. In this module, we are going to explore basic concepts of random variables. By understanding the frequency and distribution of random variables, we extend further to the discussion of probability. In the later part of the module, we apply the probability concept in measuring the risk of investing a stock by looking at the distribution of log daily return using python. Learners are expected to have basic knowledge of probability before taking this module.

- In financial analysis, we always infer the real mean return of stocks, or equity funds, based on the historical data of a couple years. This situation is in line with a core part of statistics - Statistical Inference - which we also base on sample data to infer the population of a target variable.In this module, you are going to understand the basic concept of statistical inference such as population, samples and random sampling. In the second part of the module, we shall estimate the range of mean return of a stock using a concept called confidence interval, after we understand the distribution of sample mean.We will also testify the claim of investment return using another statistical concept - hypothesis testing.

- In this module, we will explore the most often used prediction method - linear regression. From learning the association of random variables to simple and multiple linear regression model, we finally come to the most interesting part of this course: we will build a model using multiple indices from the global markets and predict the price change of an ETF of S&P500. In addition to building a stock trading model, it is also great fun to test the performance of your own models, which I will also show you how to evaluate them!

Python and Statistics for Financial Analysis FAQ’s:

The lectures and assignments for the Python finance course will depend on the type of enrolment opted by a candidate. In some cases, the candidate may get free Python training material for free.

Yes! Demo session for Python for financial analysis course is available which will help the students to take the correct decision regarding the course.

There are various payment options for the Python for finance: analyze big financial data course and they include credit card, bank transfer, instant payment, etc.

Yes! Discounts are available from time to time. It can be given during festive season or any other event or occasion.

Yes! The video for the missed class will be available so students need not worry if they miss any class.

Yes! A candidate will be taught the topic of statistics and data analysis for financial engineering as it is included in the course.

Enquire Now

Related Courses

Why QTS INFO

Best Virtual training classrooms for IT aspirants

Real time curriculum with job oriented training.

Around the clock assistance

We are eager to solve your queries 24*7 with help of our expert faculty.

Flexible Timings

Choose your schedule as per your convenience. No need to delay your work

Mock projects

Real world project samples for practical sessions